Passive Income: In today’s fast-paced world, building wealth on autopilot may sound like a dream reserved for the financial elite or tech-savvy entrepreneurs. However, passive income is an economic strategy accessible to anyone willing to invest time, effort, and some know-how. So, let’s embark on a journey to demystify passive income and explore how it can become a powerful tool in your quest for financial independence.

What Is Passive Income?

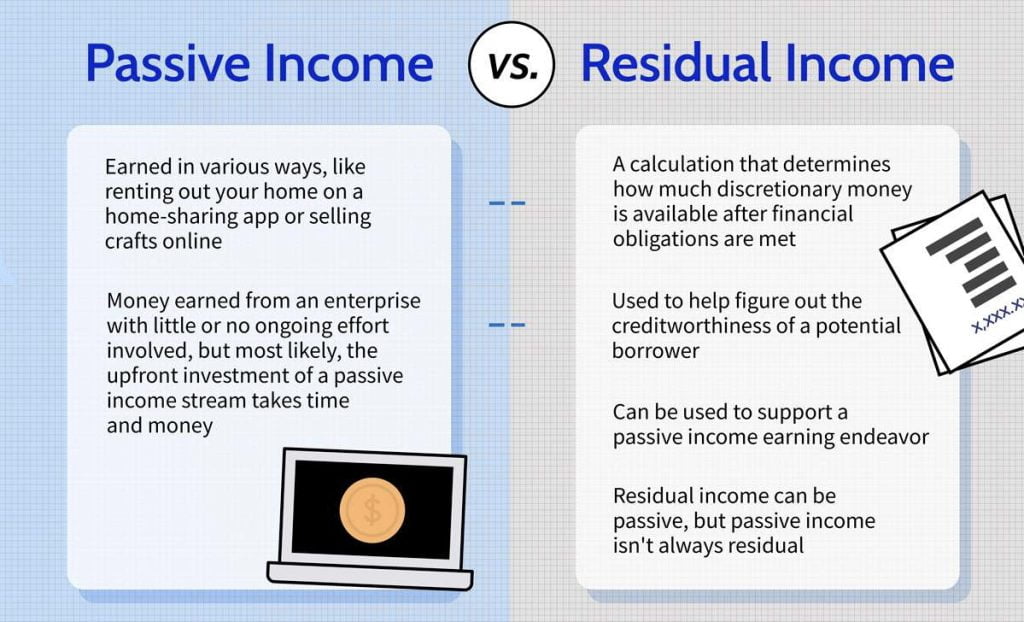

Passive income is money earned with minimal effort on your part. Unlike active income, which requires constant involvement and time, passive income streams generate revenue while you sleep, work your day job, or sip a tropical cocktail on a beach. These streams of income can come from various sources, each with its unique characteristics:

- Rental Income: Owning property and renting it out to tenants is a classic example of passive income. Whether it’s a residential apartment or a commercial space, rental income provides steady earnings.

- Dividend Stocks: Investing in dividend-paying stocks allows you to earn a share of a company’s profits regularly. These dividends are often paid quarterly and can be a reliable source of passive income.

- Interest from Investments: Bonds, certificates of deposit (CDs), and peer-to-peer lending platforms provide interest payments to investors. This interest can accumulate over time, creating a passive income source.

- Royalties and Licensing: If you’re a creative soul, you can earn passive income from your intellectual property. This includes royalties from books, music, patents, or licensing your photography.

- Real Estate Crowdfunding: Joining real estate crowdfunding platforms lets you invest in properties collectively with other investors. You can receive a share of rental income and potential profits without the hassle of property management.

The Power of Passive Income

Now that we’ve defined passive income, let’s delve into why it’s a game-changer for building wealth:

- Time Freedom: Passive income frees up your time. You’re not trading hours for dollars, allowing you to pursue other interests, spend time with loved ones, or explore new opportunities.

- Diversification: Relying solely on your job for income is risky. Passive income sources diversify your earnings, making you less vulnerable to economic downturns or job loss.

- Wealth Accumulation: Over time, passive income streams can grow substantially, accumulating wealth. As your investments compound, your wealth multiplies.

- Early Retirement: By building substantial passive income, you can potentially retire early or have the financial flexibility to work on projects you’re passionate about rather than those driven by necessity.

Getting Started with Passive Income

Here’s a beginner’s roadmap to kickstart your journey towards passive income:

- Educate Yourself: Invest time in learning about different passive income streams. Understand the risks, rewards, and required commitments for each.

- Set Financial Goals: Determine what you want to achieve with passive income. Whether paying off debt, saving for retirement, or funding your dream vacation, having clear goals will guide your efforts.

- Build Emergency Savings: Ensure you have an emergency fund to cover unexpected expenses before investing. This safety net is crucial for financial stability.

- Start Small: Begin with an attainable passive income stream. For example, open a high-yield savings account, invest in dividend stocks, or explore real estate crowdfunding platforms with a low initial investment.

- Scale Over Time: As your confidence and knowledge grow, consider diversifying and scaling your passive income sources. Reinvest your earnings to accelerate wealth accumulation.

- Seek Professional Advice: Consulting a financial advisor or tax specialist can help you optimize your passive income strategy and navigate tax implications.

- Stay Committed: Building substantial passive income takes time and dedication. Be patient and stay committed to your financial goals.

Remember that passive income is not a get-rich-quick scheme. It requires effort and persistence. However, with the right mindset and a well-thought-out plan, you can unlock the power of passive income and set yourself on a path to financial freedom and wealth building on autopilot.