Living standards in Britain are expected to fall at the fastest annual rate since the mid-1950s and will take until at least 2024 to return to pre-Covid levels, according to the government’s independent economic forecaster.

The UK is poised to enter a ‘household recession,’ as soaring prices weaken consumer confidence and force people to cut back on spending, the Confederation of British Industry (CBI), a leading business group that speaks for 190,000 UK businesses, has said, in an economic forecast issued on Monday.

Despite the measures announced by Rishi Sunak at his spring statement, the Office for Budget Responsibility (OBR) said real household disposable incomes per person would fall by 2.2% in 2022-23 as earnings from work fail to keep pace with soaring inflation.

It said the fall would be the biggest in a single financial year since modern records began in 1956-57, and that it would take until 2024-25 for inflation-adjusted living standards to return to their pre-pandemic level.

Real household disposable income forecast to fall at the fastest annual rate since 1956

“Household recession will come – making business investment even more essential,” the group said, explaining that the situation is the result of a “historic squeeze in household incomes, which will lower consumer spending.”

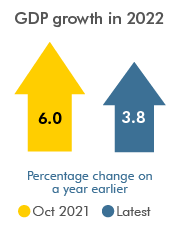

“This in turn will weaken GDP growth towards the end of this year and into the first half of next year,” the CBI stated. The group lowered its forecast for the UK’s economic growth to 3.7% this year from its previous estimation of 5.1%, and to a mere 1.0% in 2023 (from 3.0%).

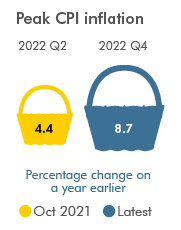

“High inflation is the primary source of weaker growth. CPI inflation reached a 40-year high in April (9%), driven higher by a cocktail of challenges – ranging from supply-chain pressures, rising commodity prices and war in Ukraine,” it said.

The group forecasts inflation to remain high well into this Autumn, rising to another peak in October (8.7%), when Ofgem (Office of Gas and Electricity Markets) is expected to raise the energy price cap.

The geopolitical situation is also contributing to destabilizing the UK economy, CBI chief economist Rain Newton-Smith said.

“This is a tough set of statistics to stomach. War in Ukraine, a global pandemic, continued strains on supply chains – all preceded by Brexit – has proven to be a toxic recipe for UK growth.”

Noting that there is a risk that the economy would be nothing but a “distant second” to politics in the coming months, CBI stressed that only decisive and immediate actions from the government could salvage the situation. The group suggested, for instance, introducing measures to curb labor shortages, and cutting taxes on company spending.

“Let me be clear – we’re expecting the economy to be pretty much stagnant. It won’t take much to tip us into a recession. And even if we don’t, it will feel like one for too many people. Times are tough for businesses dealing with rising costs, and for people on lower incomes concerned about paying bills and putting food on the table,” CBI head Tony Danker said, adding that London’s inaction in the coming months “would set in stone a stagnant economy in 2023, with recession a very live concern.”